Introducing Waivo+ Liability Insurance

Waivo has released Waivo+ liability insurance, the most comprehensive liability insurance plan for vacation rental managers and co-hosts in the industry.

If you manage or co-host vacation rentals, this article will answer many of your questions about vacation rental liability insurance.

Example of Liability

When it comes to insurance, real-life examples are the best way to educate people. For instance, a deck collapse is a common problem with short-term vacation rentals, so we’ll use this as our example.

This guest broke the house rules by hosting a party, which caused the deck to collapse and resulted in severe injuries. YET, it’s the guest who is now suing the homeowner and/or manager or co-host for negligence.

Negligent or not, vacation rental guests often sue property owners and managers for various reasons, and the legal defense alone can put you out of business.

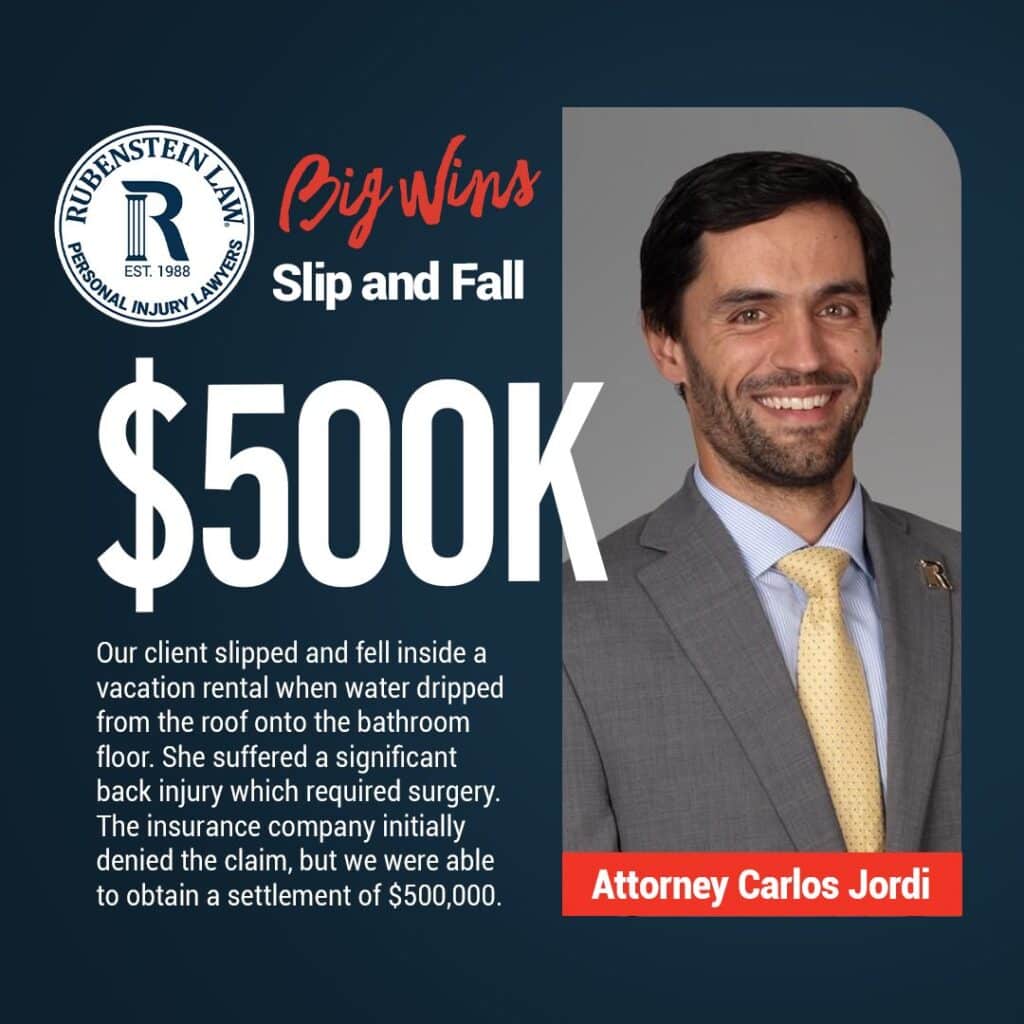

Here’s a recent case against a property manager and property owner from Beasly Allen Law.

A Matter of Time

As a vacation rental manager, it is only a matter of time before a guest gets injured at one of your properties and becomes a plaintiff.

A simple Google search will yield several personal injury attorneys who specialize in vacation rental injuries.

First Defense: Property Owners Insurance

Every vacation rental property has an owner, and the owner’s insurance provides property coverage for perils such as fire, wind, and hail damage. But, it also carries liability coverage, which is protection against “bodily injury” claims from a third party, such as a guest.

Get Added As Additionally Insured

Whether you manage five or five hundred properties, you should always request to be added as additionally insured onto your owner’s insurance policies. Then, if you are named in a lawsuit for an injury at the property, you have liability coverage under their policy.

Request a certificate of insurance (COI) showing you as additionally insured and a certificate holder. As a certificate holder, you will be notified if they remove you or cancel their policy.

Proper Insurance is our exclusive referral for property owner insurance, and they automatically add property managers as additionally insured and certificate holders.

Second Defense: Waivo+ Liability Insurance

The Waivo+ liability insurance policy provides commercial general liability coverage of $1,000,000. The policy is issued to the property manager, with the property manager being named as the insured party. The premium or cost is only billed for the nights on which the managed properties are rented.

Automatically Extends To Properties You Manage

The $1,000,000 in liability coverage automatically extends to the vacation rentals you manage, protecting the manager and the property owner.

Exclude Properties You Are Additionally Insured

As discussed earlier, the first and best line of defense is the property owner’s insurance, with the manager added as additional insured. These properties can be added to the excluded list; therefore, no premium would be charged for their rented nights.

Pass The Cost Onto Your Property Owners

Advise property owners who are incapable or unwilling to add you to their insurance that they will automatically be enrolled in your Waivo+ liability insurance policy, which provides $1,000,000 in commercial general liability.

Explain the coverage is billed only for the nights the property is rented and will be included on their monthly owner statement.

Third Defense: Platform Protection or Business Owners Policy

Both Airbnb and Vrbo include $1,000,000 liability insurance policies for bookings made on their platform. However, there are three major issues with this.

Unfortunately, since you are not listed as a named insured on the policy, you do not have any policy rights. Therefore, you will not have any recourse in the event of any disagreements regarding coverage.

Both policies have a list of exclusions, not commonly found in commercial general liability, such as personal and advertising injury.

To increase your bookings, it’s essential to encourage guests to book directly with you instead of relying solely on Airbnb and Vrbo.

As far as a business owner’s policy; getting commercial general liability to extend to the properties you manage is extremely expensive and hard to find. It’s not a risk most insurance carriers will take on.

If you were ever sued as the result of bodily injury at a property you manage, you want the property owner’s policy or Waivo+ to respond; not rely on a business owner’s policy.